How to fill 83(b) Election, your way.

The steps below are convenient starting point for most businesses. You can customize anything to fit your unique needs.

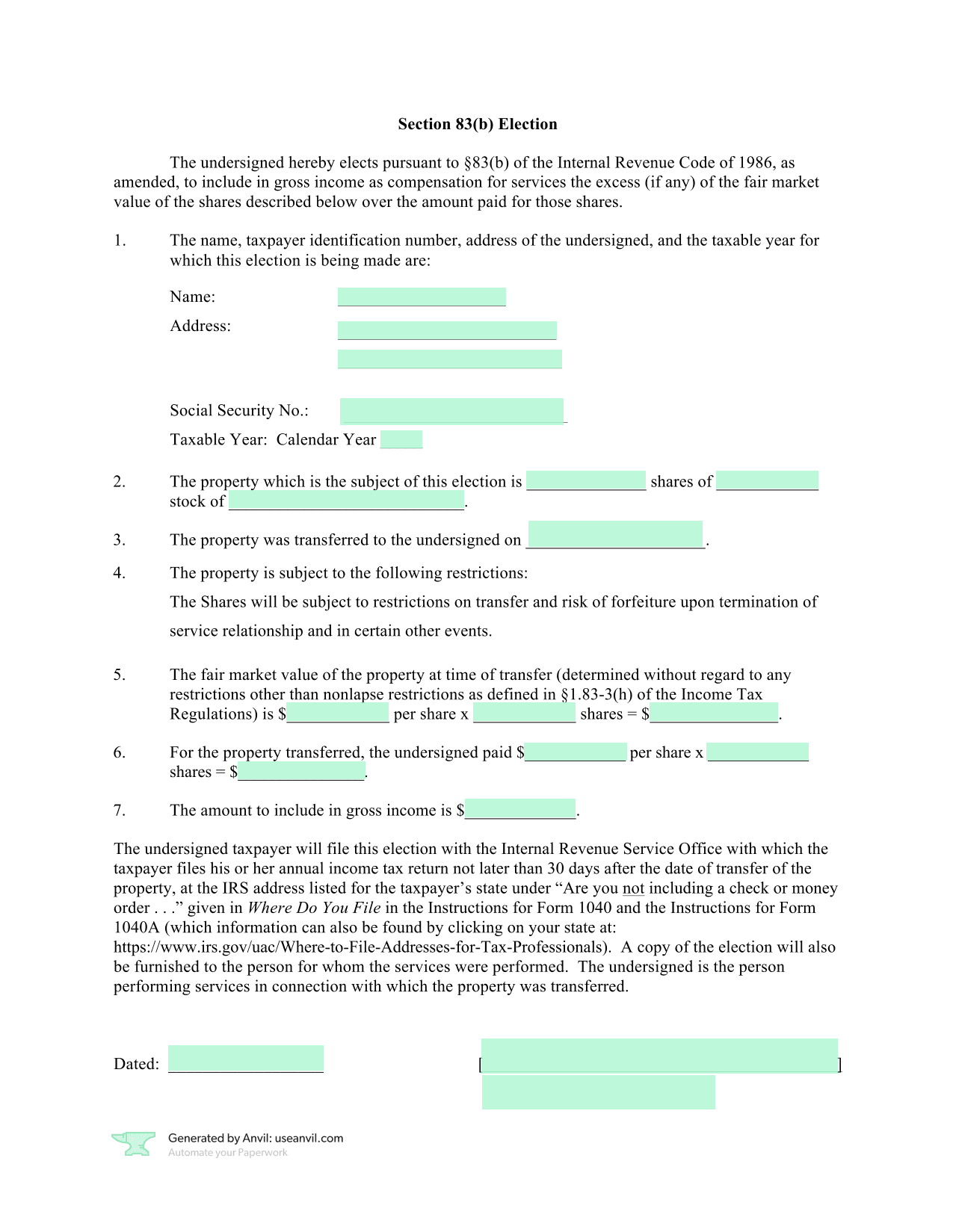

Fill 83(b) Election with your data

Option 1: via API

If you already have the data, you can use Anvil's PDF filling endpoint to fill the 83(b) Election PDF template from any application. Send your data as JSON and receive the filled PDF.

Option 2: via Webform

Sign up to use this templateGenerate filled PDF documents with user-submitted data collected through the Webform.

Need to collect data first? Use our pre-made Webform.

Use our intuitive production-ready Webform to collect data from your users. We already set up all the questions so you don't have to.

Embed it into you product and customize styling to create a seamless on-brand experience for your clients or end users.

Preview this WebformCollect e-signatures in the same workflow

No need to use 3rd party E-sign services - Anvil makes it easy to get your forms signed in the same workflow.