How to fill IRS W-9, your way.

The steps below are convenient starting point for most businesses. You can customize anything to fit your unique needs.

Fill IRS W-9 with your data

Option 1: over API

If you already have the data, you can use Anvil's PDF filling endpoint to fill the IRS W-9 PDF template from any application. Send your data as JSON and receive the filled PDF.

Option 2: from Webform

Sign up to use this templateGenerate filled PDF documents with user-submitted data collected through the Webform.

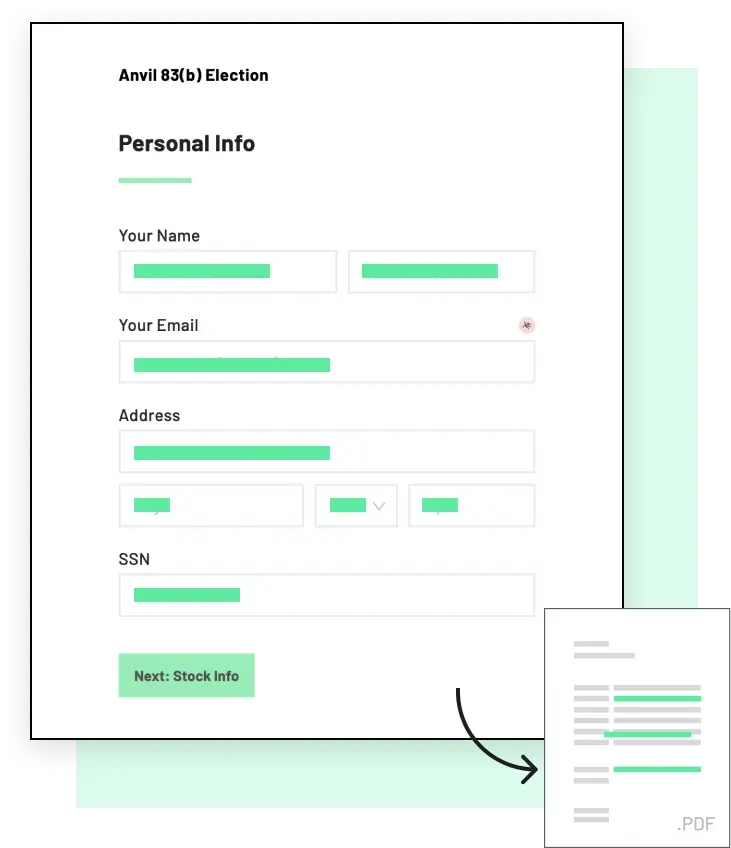

Need to collect data first? Use our pre-made Webform.

Use our intuitive production-ready Webform to collect data from your users. We already set up all the questions so you don't have to.

Embed it into you product and customize styling to create a seamless on-brand experience for your clients or end users.

Collect e-signatures in the same workflow

No need to use 3rd party E-sign services - Anvil makes it easy to get your forms signed in the same workflow.