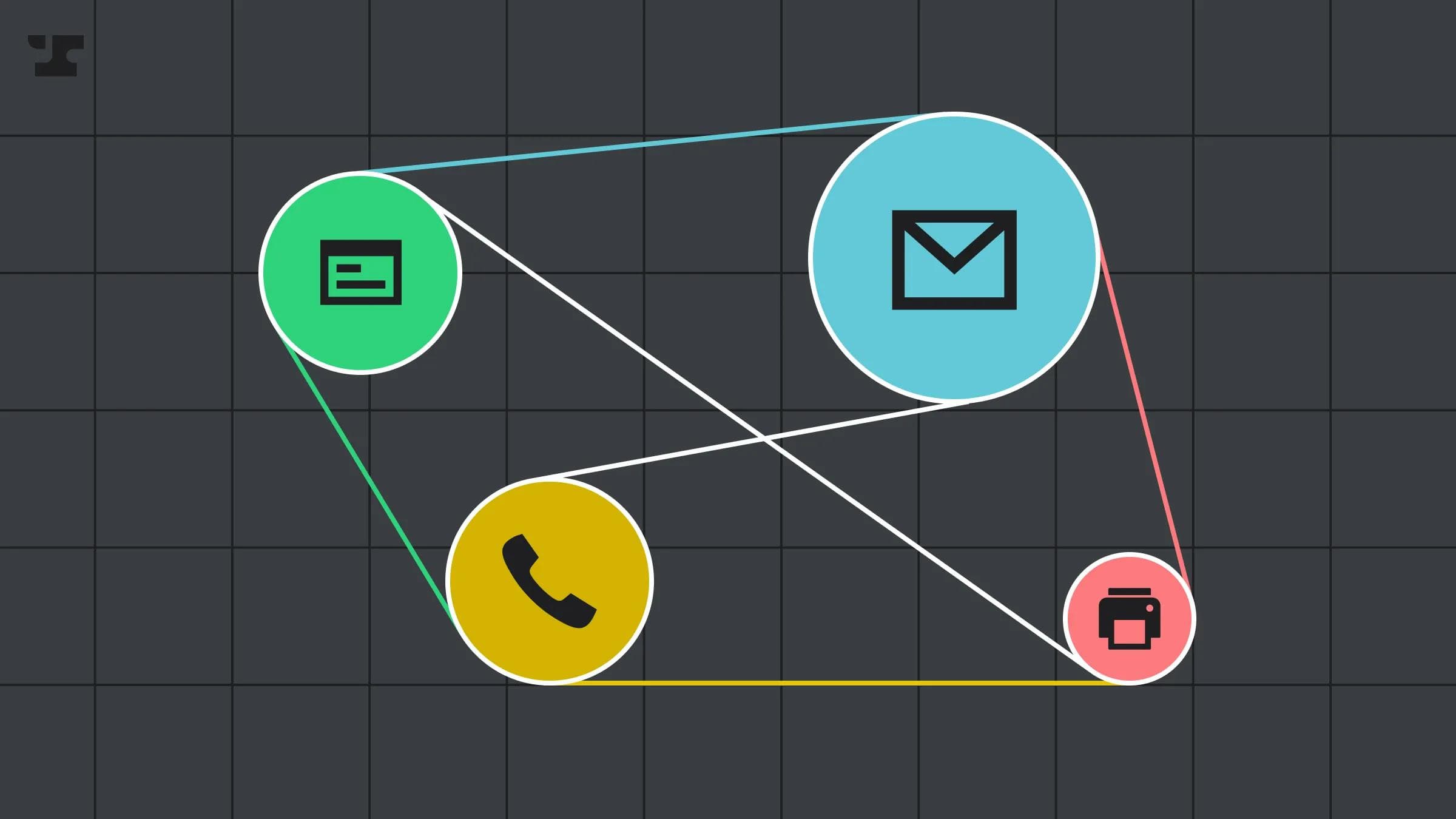

The insurance industry operates in a complex communication environment, relying on a mix of email, phone, web portals, and (even though it’s 2025) fax. This multichannel servicing is essential for managing claims, policy updates, and customer inquiries. However, with so many communication methods, it’s easy for important details to get lost, resulting in company inefficiencies that hurt customer satisfaction and damage reputation. With insurance prices as tightly regulated as they are, reducing the cost to serve customers is one of the most effective ways for insurers to increase profitability. Streamlining processes, minimizing administrative overhead, and automating workflows can significantly lower operational expenses.

Customer satisfaction is equally critical because growth in the insurance sector depends on expanding distribution and attracting more policyholders. By maximizing the number of policies sold and ensuring steady premium payments, insurers build a reliable annuity stream, allowing them to invest that capital and generate additional returns over time.

Anvil’s Document SDK offers a powerful solution to these challenges. By automating document workflows for multichannel communication, Anvil streamlines data handling, ensuring consistency and efficiency across every channel within your existing application and brand.

How Anvil supports multichannel communication servicing in insurance

Anvil’s flexible API enables insurers to integrate automation across all communication channels. By embedding customizable, templatized documents directly into your application, it’s easy to manage policy updates, claims, and customer interactions without missing critical information or experiencing fewer errors.

So how does this work across each individual communication channel?

For customers who prefer or utilize email – and according to a 2022 survey 64% of respondents cited it as their preferred method – Anvil simplifies document workflows with guided form-filling processes. Insurers can send customers an Anvil link that walks them through completing forms step-by-step. Whether it’s a claims submission or a policy update, this approach ensures data accuracy while providing a user-friendly experience. Once the filled form is received, that data can be synced across all other channels in that customer’s profile.

Phone

When it comes to customer support, which in insurance can involve a question about a policy or a settlement, Zoom indicates that 51% of people prefer that support be done over a phone call.

Anvil’s platform supports this channel by enabling representatives to input customer information directly into an Anvil Workflow during the call. For example, a rep can gather policy update details over the phone, input the data into the insurer’s system and provide validation to ensure data is clean via Anvil, as well as automatically update the customer’s record. This eliminates the need for manual data reentry, reducing errors, and speed up slow, multi-step paperwork processes.

Web

Many customers prefer managing their insurance online, and many insurers offer a proprietary web and application experience accordingly. With Anvil, insurers can host branded, embedded workflows directly on their digital platforms, creating a cohesive and familiar experience. These web-based workflows allow customers to complete tasks like updating personal information or submitting claims independently, with the assurance that their data is processed securely and consistently.

Certain demographics, generally amongst younger generations, prefer self-serve online options and want to have as few interactions as possible regarding their policy. With Anvil seamlessly embedded in your applications, this preferred communication method can be achieved, and the data can be gathered and sorted cross-channel.

Fax

Although outdated, fax remains a critical communication channel for many insurers. Although Anvil doesn’t provide OCR (optical character recognition), many OCR providers mesh with Anvil so that faxed documents are converted into actionable, digital data. This data is then validated and automated within Anvil’s Document SDK, ensuring that even fax-based submissions are seamlessly integrated into the insurer’s workflows.

Benefits of multichannel servicing

As omnichannel journeys become the new reality, insurers must work to offer their products and services seamlessly across all available channels, integrating digital and personal touchpoints. Digital channels should complement, not replace, personal interactions, which remain important for insurance-related needs (BCG, 2023).

- Increased efficiency: Automating document workflows for multichannel communication eliminates manual data entry, saving time and ensuring faster processing across all customer touchpoints.

- Error reduction: With built-in validation capabilities, Anvil ensures consistent and accurate data collection, reducing the risk of errors caused by manual handling.

- Improved customer experience: Customers can interact with their insurer through their preferred communication channel without encountering delays or friction. This seamless service experience builds trust and loyalty.

- Operational cost savings: Automating processes, especially those involving manual data handling like fax submissions, reduces operational costs. By integrating OCR solutions with third-party partners, insurers can further optimize fax processing.

Case study: Vouch transforms its insurance operations with Anvil

Vouch, an innovative business insurance provider, successfully implemented Anvil to automate its policy servicing workflows. By embedding Anvil’s document automation into its processes, Vouch achieved faster data collection, seamless integration across channels, and enhanced customer satisfaction.

Their success demonstrates how multichannel insurance technology can revolutionize document workflows, helping insurers manage policy updates and claims with ease while reducing errors and inefficiencies. For more details, check out Vouch’s success story of insurance reimagined.

Managing multichannel communication servicing in insurance, a paperwork-heavy industry is no longer an insurmountable challenge. Through automation, insurers can streamline document workflows across email, phone, web, and fax, improving efficiency and delivering a better customer experience. By automating processes and ensuring data consistency, Anvil enables insurers to focus on what matters most: serving their customers.

Discover how Anvil can help your organization improve efficiency, reduce errors, and enhance customer satisfaction. Book a demo today to see Anvil’s solutions in action.